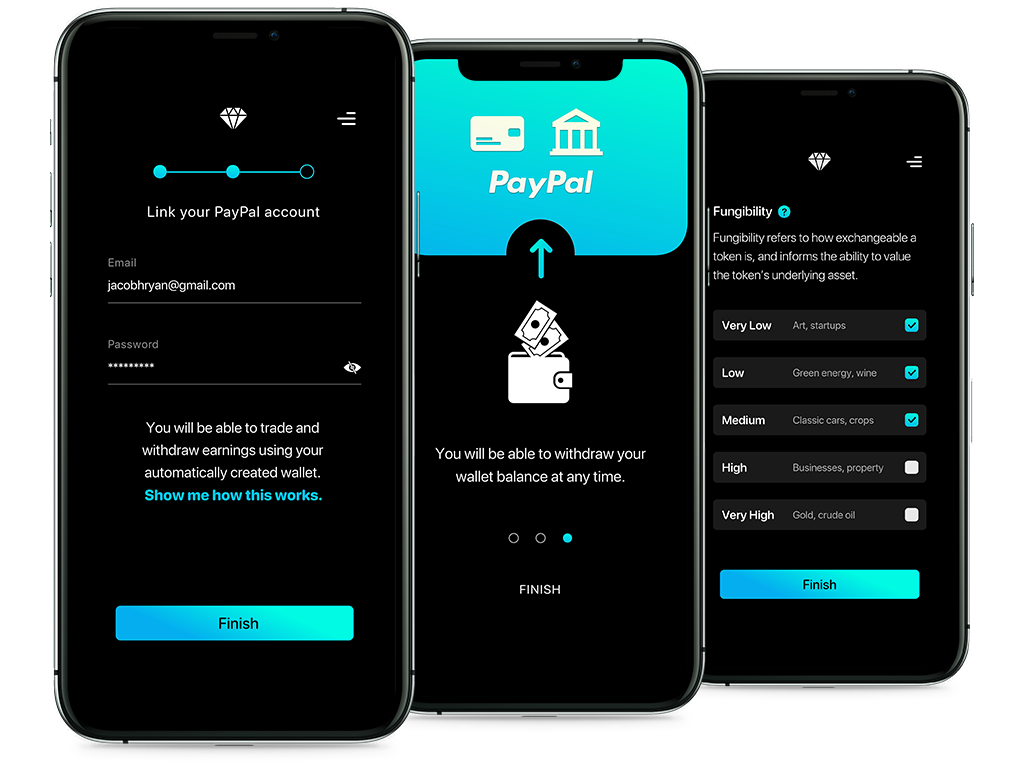

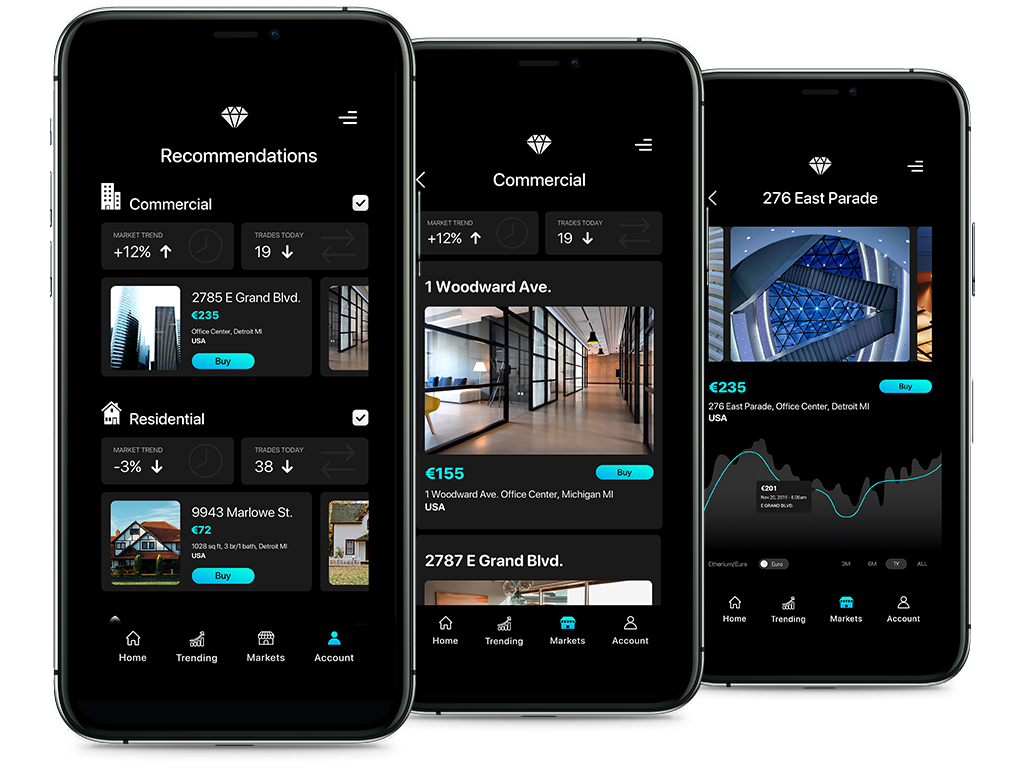

An Irish investment firm approached us to research an emerging financial instrument known as Tokenised Assets.

These allow for the division of a real-world asset – e.g, a residential or commercial property – into tokens, which can be sold individually via the blockchain.

This new instrument is being regarded by some as the asset class of the future. Our client wanted us to investigate the customer experience that investors might have when trading in such a new market.