Interviews were conducted online with insurance holders regarding the existing quote flows. Analysis of these sessions revealed numerous areas for improvement. Our recommendations were shaped into a prioritisation matrix to determine the feasability, viability and desirability of the proposed features.

Low-fidelity prototypes were created based on these findings, which were again tested with end users for refinement-focused feedback. This user-centred design process continued with high-fidelity screen designs later being tested with users in a final round of feedback-gathering, resulting in screen designs ready for production.

Throughout the process, our findings and designs were continuously pitched to internal stakeholders for feedback and approval, ensuring that each change was aligned with company objectives.

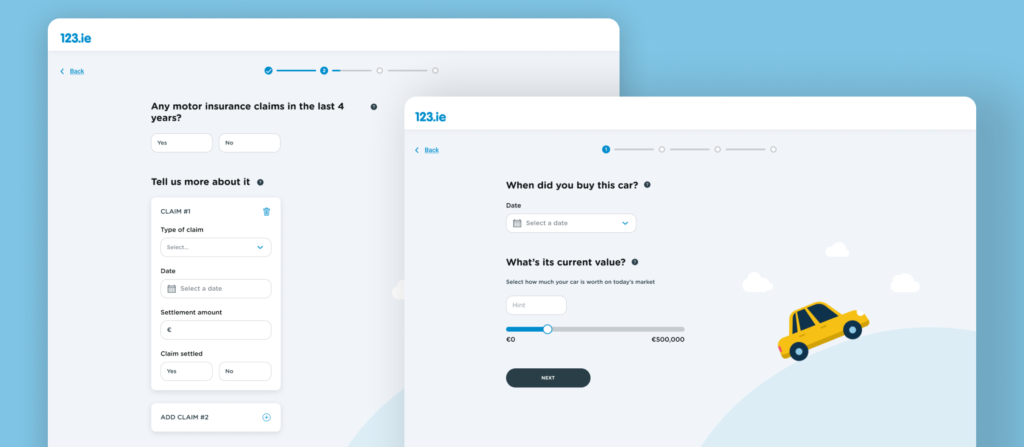

INSURANCE CLAIMS & CAR TYPE QUESTIONS

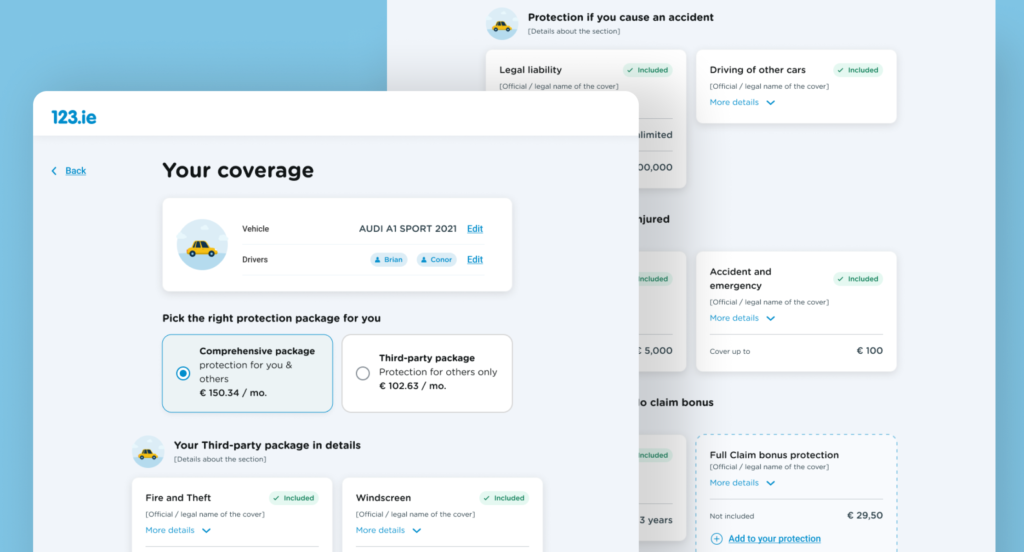

We leveraged the RSA design system Iceberg to create the UI screens. These were created using a mixture of approved 123.ie branded components and, where necessary, new components for specific use cases. New components were fed back for incorporation into the design system to ensure consistency going forward.

COVERAGE SCREENS